Chart of the Day - October Live Cattle

The information and opinions expressed below are based on my analysis of price behavior and chart activity

Tuesday, August 26, 2025

If you like this article and would like to receive more information on the commodity markets from Walsh Trading, please use the link to join our email list -Click here

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

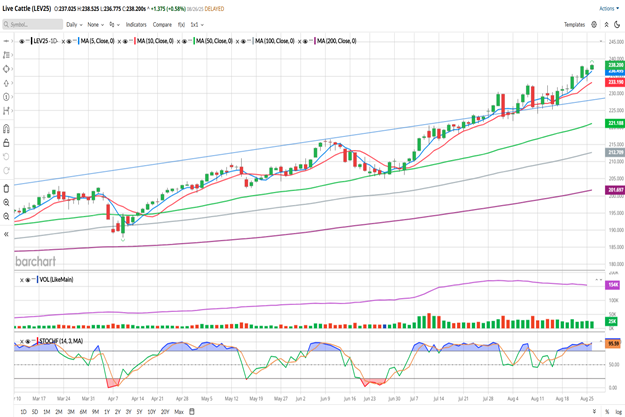

October Live Cattle (Daily)

October Live Cattle closed at 238.200 on Tuesday, adding 1.375 on the day. Friday’s Cattle on Feed

report from the USDA showed 10.922 million head, which I believe is the lowest number in about 6 ½

years. That’s a 2% decline from last year’s report, with both Placements and Marketings declining by 4%

on a year-to-year basis. In my opinion, those numbers are bullish for prices. We did get a bearish push

down to start the week. There was news over the weekend of someone traveling to Central America and

bringing back a New World Screwworm. Not in a petri dish, but in an infected or open wound. Allegedly,

the CDC got involved and there is no threat to either humans or our food chain. But the news was

enough to start the market sharply lower yesterday. By the close, they had rallied some 3.300 off of the

lows, before setting new contract highs today.

By looking at the chart above, you may notice a few things. The 5- and 10-day moving averages

(blue/red, 236.495/233.190, respectively) are below the market and are pointing higher, offering

potential support. The blue trendline, drawn off of the Jan-June highs, is also offering a potential

support level, near 228.000 or so. That trendline was resistance, but since breaking higher in late July,

the trendline has now become a support level. The 50-, 100- and 200- day averages are well below the

market. The 50-day (green) is the closest, near 221.18. If we were to trade back there, that average may

prove to be key support, much like it did in Feb, April and June. Stochastics (bottom sub-graph) is in

overbought territory, and has been since August 15th. You may agree that this market has preferred to

stay overbought, going back to the beginning of this chart in March. It has maintained that condition

throughout most of July.

The one bearish caveat that I have to share is this: the last trading day of the month is Friday. That’s also

the day before a 3-day weekend. If you recall, on the last day of July, this October contract shed 6.575 in

value as traders booked profits. We’re currently up 15.050 in August. July ended the month up 12.975,

after the 6.575 selloff. If Wednesday and Thursday result in nice gains, don’t be surprised by a profit

taking drop on Friday.

Make no mistake, though. Technically and fundamentally, the Cattle markets are bullish and showing no

real signs of slowing.

If you like what you’ve read here and would like to see more like this from Walsh Trading, please Click here and sign up for our daily futures market email.

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

October Live Cattle (Weekly)

So far for this week, the October Live Cattle are up 0.325. From low to high, it’s had a decent range in just 2 days of 5.000. That’s a bit shy of the average weekly range of 9.00 that the Cattle market has posted over the last 4 weeks. But there’s still 3 days left in the week. If we assume that the market has already made it’s low for the week, a similar 9.00 range this week would project to a high of 242.525. But assumptions and projections are rarely accurate, so take that with a grain of salt.

I’m still bullish the Cattle market, as I’ve not yet seen anything to change my mind. We have less cattle and more people to feed. Retail demand remains strong, no matter how many newswire articles there are about high beef prices. Boxed Beef prices continue to rise this week, indicating to me that the retailer demand remains strong. At the current moment, demand destruction is the only bearish outlier, in my opinion. And we’ve not seen anything approaching that yet.

On the weekly chart above, I’ve added a simple Fibonacci retracement from the March lows to this week’s high. I picked that low because it’s the most significant and recent low, and this week’s high because….it’s the high. I put this on the chart to illustrate how far the market could come back down (not that I expect it to) and STILL be in a bullish trend. The 5-and 10-week moving averages (blue/red, 231.275/223.978, respectively) have been in a bullish configuration since the 2nd week of March. A 23% retracement pegs to about 226.250. That doesn’t even get prices down to the 10-week average, the uptrend would still be intact. Even a “textbook” 38% move pegs close to 218.675. That would break through the 10-week average, but still not change the trend.

Seasonal Data can be found here, if you’re interested. Given the supply/demand equation here in the Cattle markets, I don’t think the seasonal patterns or tendencies matter very much.

If you like what you’ve read here and would like to see more like this from Walsh Trading, please Click here and sign up for our daily futures market email.

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.