As Opendoor Launches a Community Hub, Should You Buy, Sell, or Hold OPEN Stock?

Opendoor Technologies (OPEN), once the darling of the pandemic housing boom, was left battered as rising interest rates and a frozen housing supply crushed its iBuying model. But 2025 has sparked a stunning comeback.

OPEN stock surged over 16.2% in a single session on Sept. 4. The next day, shares touched a 52-week high of $6.85, climbing 11.6% intraday on hopes of housing market stabilization, improved unit economics, and a path toward profitability. Opendoor President Shrisha Radhakrishna announced a “community hub” to deliver transparent updates and source questions from its passionate retail base — the self-styled “$OPEN Army.”

Hedge fund manager Eric Jackson, a vocal supporter, met with executives in San Francisco, amplifying investor enthusiasm. Board member Adam Bain also praised the “relentless hive mind of ideas” from Jackson and investors, driving retail sentiment.

With trading volumes surging and retail chatter hitting fever pitch, OPEN stock has transformed into a battleground where social media hype meets high-stakes conviction. Amid the excitement, is OPEN stock’s rebound a genuine turnaround story? Or just another meme-fueled sprint?

About Opendoor Stock

Headquartered in San Francisco and founded in 2014, Opendoor is reimagining real estate by turning home buying and selling into a seamless digital experience. For over a decade, the firm has served tens of thousands nationwide, now acting like the “Amazon of housing.” It pioneered iBuying — purchasing homes directly, reselling them online, and removing the hassle of agents, paperwork, and delays. With instant offers, financing support, and nationwide reach, Opendoor simplifies complex moves. Going public via a special purpose acquisition company (SPAC) merger in 2020, Opendoor now has a market capitalization of about $4.9 billion.

OPEN stock’s journey has been highly volatile lately. Once staring down a Nasdaq delisting warning after dipping under $1 for 30 straight days, the company moved fast - proposing a reverse stock split in June to keep its head above water. Then came the meme-stock frenzy, insider buying, and hedge fund voices like Eric Jackson cheering from the sidelines.

From a June low of $0.51, OPEN has now rocketed past the $6 mark. The stock is up by a jaw-dropping 316% year-to-date (YTD) gain, leaving the S&P 500 Index’s ($SPX) low double-digit climb in the dust. Over the past three months alone, OPEN stock has skyrocketed 907%. Expectations of lower interest rates and the potential for short squeezes ignited the rally, converting cautious traders into aggressive buyers and driving the share price sharply higher.

With a 14-day RSI at 76.9, OPEN exhibits strong bullish momentum, but is trading in overbought territory now.

Despite the rally, OPEN stock still feels like it is flying under Wall Street’s radar. At just 0.85 times forward sales, well below the sector average, shares trade at a steep discount — tempting for bulls, but a reminder that the market’s trust is not fully back yet.

Opendoor’s Q2 Earnings Snapshot

On Aug. 5, Opendoor dropped its second-quarter earnings report, and the story was one of resilience battling headwinds. The digital real estate player generated $1.6 billion in revenue, marking a 4% year-over-year (YOY) gain and slightly edging past Wall Street’s expectations. The bulk still comes from home sales and related services, and despite a slowing housing market, Opendoor proved it still moves serious volume, with 4,299 homes sold and 1,757 acquired during the quarter.

But here’s where it gets interesting. Adjusted EBITDA swung positive at $23 million, a meaningful turnaround after several loss-making quarters, and the firm's first EBITDA profitability since 2022. The discipline baked into Opendoor's operations is finally showing results. Meanwhile, GAAP net losses narrowed sharply to about $29 million, and adjusted net loss shrank to just $9 million. That's versus a $31 million loss in Q2 2024 and a $63 million in Q1 2025.

On the liquidity front, Opendoor flexed some muscle. The company ended Q2 with $789 million in cash and cash equivalents, $396 million in restricted cash, and about $1.5 billion in real estate inventory on the books. Add to that a $325 million convertible notes exchange in May, which bolstered liquidity and extended maturities, and you have a healthier balance sheet than before.

Still, the clouds are not gone yet. In the shareholder letter, former CEO Carrie Wheeler admitted that housing market activity slowed steadily as the quarter progressed. And the road ahead looks bumpy. Management anticipates Q3 revenue between $800 million and $875 million, signaling a sharp sequential pullback, while adjusted EBITDA is projected back into negative territory, at -$28 million to -$21 million. The shift toward a more asset-light model is underway, but until it fully kicks in, compressed resale margins remain a risk.

Opendoor’s Q2 marks an inflection point, a rare chapter of profitability wrapped in a market that is still testing its limits. The company’s strategy is evolving, the fundamentals are improving, but the macro storm clouds are not clearing just yet.

Analysts, meanwhile, forecast Opendoor inching closer to stability. They project fiscal 2025 losses to narrow 41.5% YOY to $0.31 per share, with another 29% improvement in fiscal 2026 to a loss of $0.22 per share. That’s a slow but steady march toward profitability.

What Do Analysts Expect for OPEN Stock?

Recently, there has been a swirl of mixed analyst calls on Opendoor, and the tone has been anything but unanimous. For instance, on Aug. 6, UBS bumped its price target to $1.60 from $1.30 but waved a caution flag, saying it no longer expects annual revenue growth in fiscal 2026 or a potential adjusted EBITDA breakeven, and sees home-price depreciation as a key headwind. Meanwhile, Citigroup took a harsher stance, downgrading to a “Sell” rating with a $0.70 target, citing weaker guidance and rising execution risks.

After Opendoor’s Q2 report, Keefe, Bruyette & Woods analyst Ryan Tomasello downgraded OPEN to “Underperform” with a $1 target, warning about wider second-half losses and uncertainty around the firm's platform pivot. Analysts are waiting for proof of stability before turning bullish.

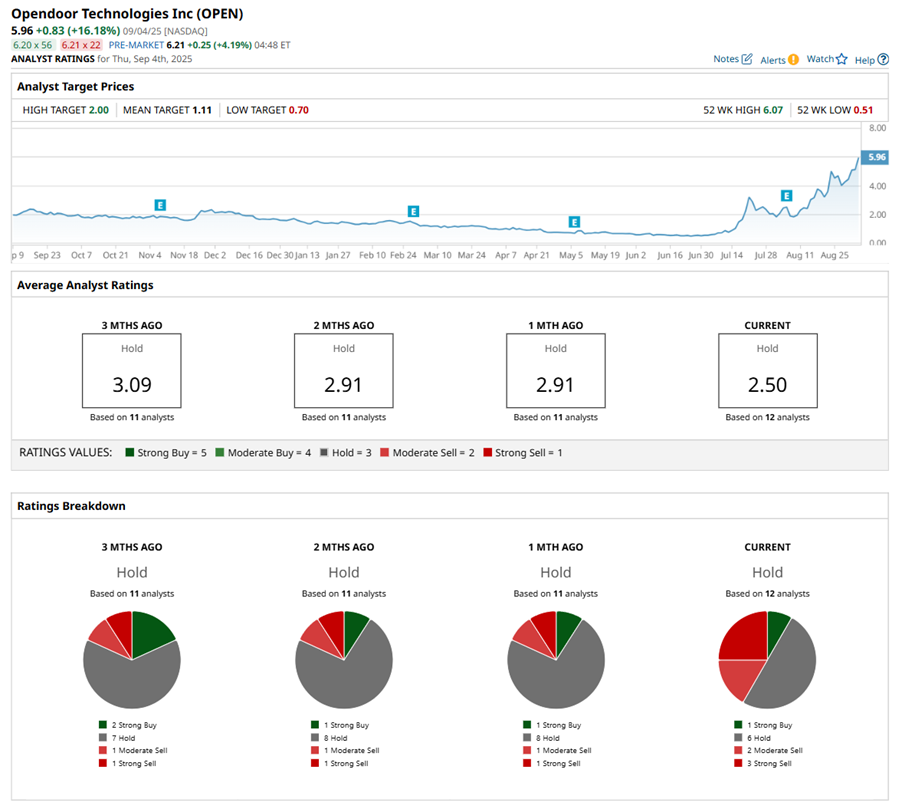

Wall Street’s read on OPEN stock is cautious, and it shows in the ratings. Overall, the stock has a consensus “Hold” rating. Of the 12 analysts offering recommendations, one analyst has a “Strong Buy,” six play it safe with a “Hold” rating, two advise a “Moderate Sell,” and the remaining three are outright skeptical with a “Strong Sell" rating.

But the market is probably ignoring the caution. OPEN stock has blown past its $1.11 average price target and is trading at three times the Street’s highest target of $2. It is less about analyst math now and more about momentum, memes, and a market daring the Street to catch up.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.