How Is CSX Corporation's Stock Performance Compared to Other Railroads Stocks?

/CSX%20Corp_%20railcar-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $60.6 billion, CSX Corporation (CSX) is one of the leading transportation companies in the United States, providing rail-based freight transportation services across the country and into Canada. Through its extensive network of nearly 20,000 route miles and approximately 3,500 locomotives, the company connects key population centers, production sites, and distribution facilities.

Companies valued over $10 billion are generally described as “large-cap” stocks, and CSX fits right into that category. CSX’s services include rail and intermodal transport, rail-to-truck transfers, and the movement of a wide range of commodities, making it a critical link in the North American supply chain.

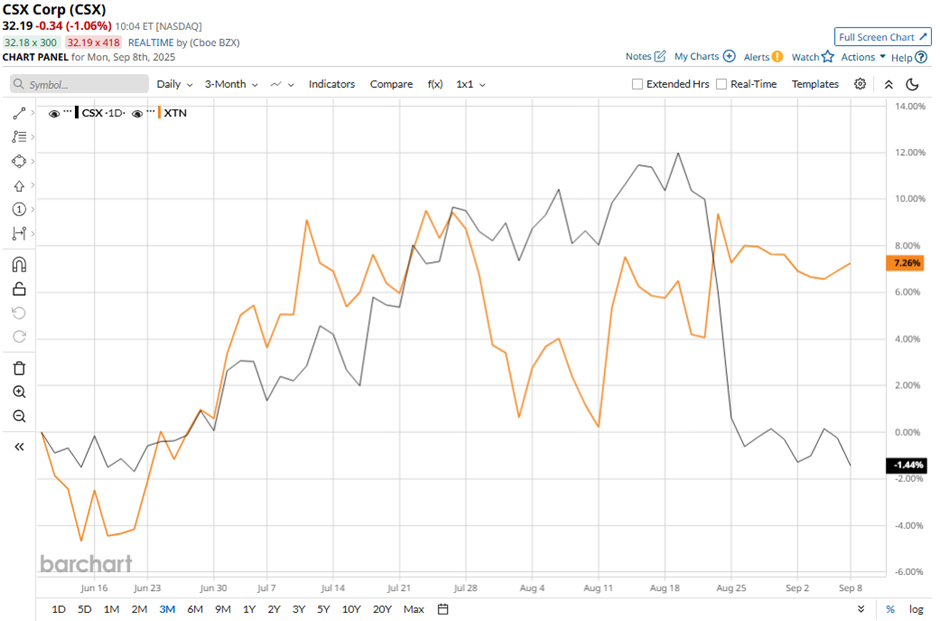

Shares of the Jacksonville, Florida-based company have decreased 13.5% from its 52-week high of $37.25. CSX’s shares have risen marginally over the past three months, underperforming the SPDR S&P Transportation ETF’s (XTN) 10.3% gain over the same time frame.

In the longer term, shares of the freight railroad have declined 3.4% over the past 52 weeks, lagging behind XTN’s 13.9% return over the same time frame. However, the stock is down marginally on a YTD basis, a less pronounced decline than XTN’s decrease.

CSX stock has fallen below its 50-day moving average since late August.

Despite weaker-than-expected Q2 2025 revenue of $3.57 billion on Jul. 23, CSX shares rose marginally the next day because EPS came in at $0.44, beating analyst expectations. The upside surprise was driven by a 2% rise in intermodal volumes, which account for 14% of revenue, and improved network efficiency that reduced extra costs faster than anticipated.

In addition, CSX stock has performed better than its rival, Union Pacific Corporation (UNP), which dropped 4.7% on a YTD basis and 12.9% over the past 52 weeks.

Despite the stock’s outperformance relative to its peers, analysts remain cautiously optimistic about its prospects. CSX stock has a consensus rating of “Moderate Buy” from 26 analysts' coverage, and the mean price target of $37.71 is a premium of 17.2% to current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.