Here's What to Expect From Meta Platforms' Next Earnings Report

Valued at a market cap of $1.8 trillion, Meta Platforms, Inc. (META) is a global technology conglomerate that owns and operates a suite of highly used social media and communication products, including Facebook, Instagram, WhatsApp, Messenger, and Threads. The Menlo Park, California-based company is scheduled to announce its fiscal Q3 earnings for 2025 after the market closes on Wednesday, Oct. 29.

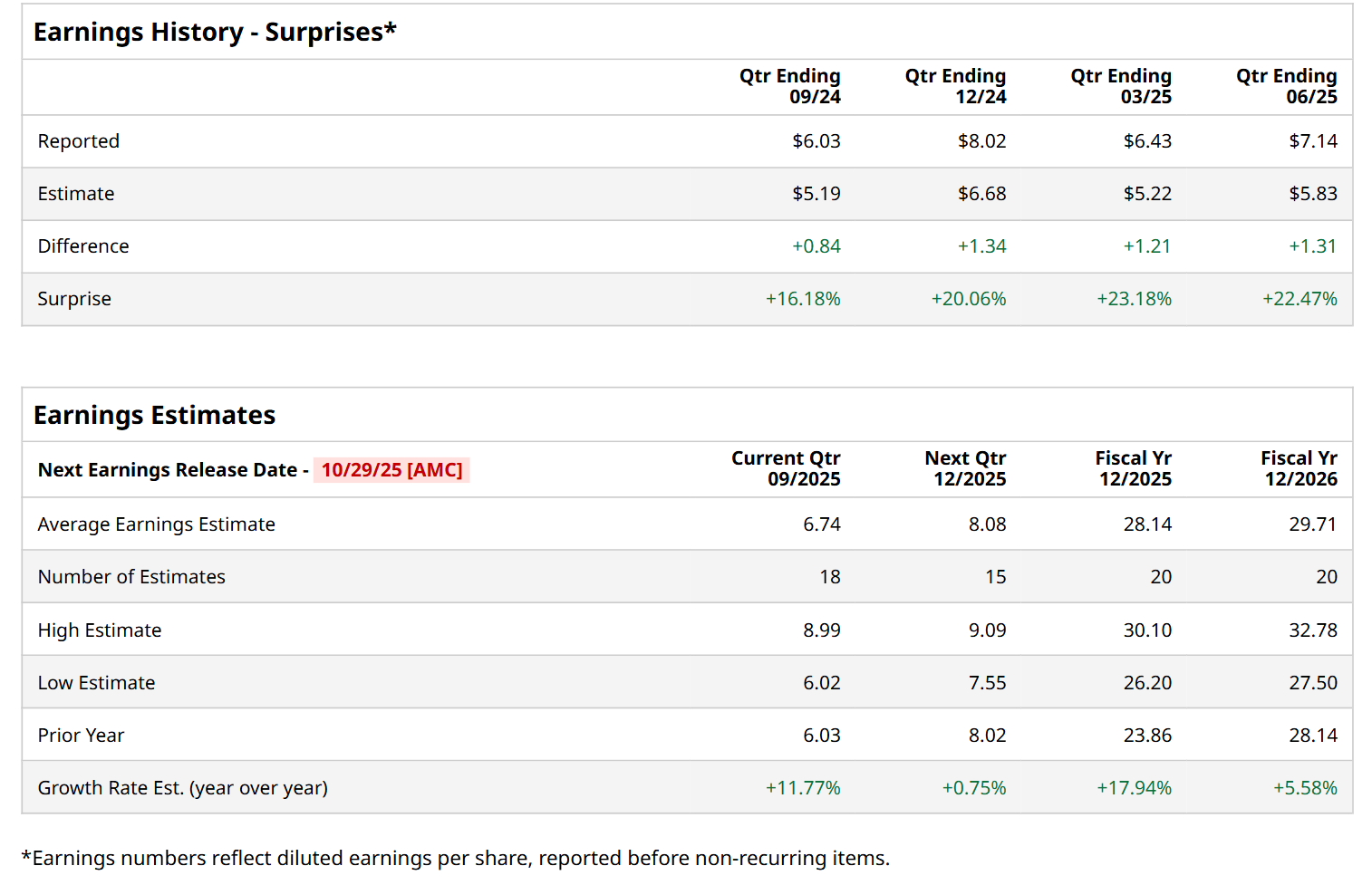

Ahead of this event, analysts expect this social media giant to report a profit of $6.74 per share, up 11.8% from $6.03 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. In Q2, META’s EPS of $7.14 exceeded the forecasted figure by a notable margin of 22.5%.

For fiscal 2025, analysts expect META to report a profit of $28.14 per share, representing a 17.9% increase from $23.86 per share in fiscal 2024. Furthermore, its EPS is expected to grow 5.6% year-over-year to $29.71 in fiscal 2026.

META has soared 21.1% over the past 52 weeks, outpacing the S&P 500 Index's ($SPX) 17.4% return over the same time frame. However, it has lagged behind the Communication Services Select Sector SPDR Fund’s (XLC) 27.8% uptick over the same time period.

META posted better-than-expected Q2 results on Jul. 30, sending its shares up 11.3% in the following trading session. Due to strong growth in advertising revenues, the company’s overall revenue improved 21.6% year-over-year to $47.5 billion, surpassing consensus estimates by 6%. Moreover, its net income per share of $7.14 grew 38.4% from the year-ago quarter, topping analyst expectations by a notable margin of 22.5%.

Wall Street analysts are highly optimistic about META’s stock, with a "Strong Buy" rating overall. Among 57 analysts covering the stock, 47 recommend "Strong Buy," three indicate "Moderate Buy," six suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for META is $872, implying a 21.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.